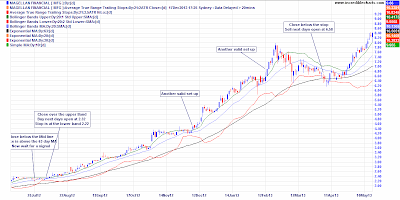

So Far I have put up

charts for all the trades I have made for this system that had a July

start date. I like to look at my trades in blocks, almost as a

portfolio result, because I believe that trading isn't about any

individual trade, rather, it is a process of accumulating trades and their distribution of results. I will discuss this, and some of the following

maths, in another Method post in the near future but for now let's

look at this group of trades in a couple of useful ways.

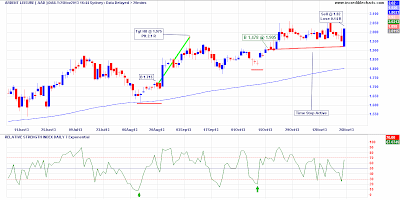

The first way is to

calculate the expectancy in terms of risk. There were seven trades

in total in July. Each trade had a fixed amount of risk (referred to

as R) and the returns shown as multiples of R were (0.50), 2.78,

(0.21), 2.92, 0.09, 0.34 & 2.10

The simpler form of

calculating expectancy is (Win% x Avge Win) – (Lose% x Avge Loss)

so on the above numbers we had

5 winners

totaling 8.23R

2 losers totaling

0.71R

So the expectancy is

( (5/7) x (8.23/5) ) –

( (2/7) x (0.71/2) )

=> (0.714 x

1.646) – (0.286 x 0.355)

=> 1.175 – 0.102

So Expectancy for July

was = 1.07

The other useful way of

looking at returns is to round each return to the nearest R and chart

the distribution

What

I am looking for here is called Skewness - a

measure of symmetry, or more precisely, the lack of symmetry. A

distribution, or data set, is symmetric if it looks the same to the

left and right of the center point. It is skewed

if it bulges out to one side of center.

All

my efforts in trading are aimed at creating an uneven distribution of

returns with very few losses of more than 1R and many profits that

push as far to the right of the bell curve as possible.

By

either measure the July block of trades were stunningly good. I

generally expect to hit an expectancy of between 0.5 and 1.0 and a

win% of 42% - 52% over the long term but these trades were taken

during a sweet spot on the ASX. It's important not to get too

carried away by a small collection of trades as we will see in

forthcoming posts. This number of trades isn't even statistically

significant but one has to start somewhere.