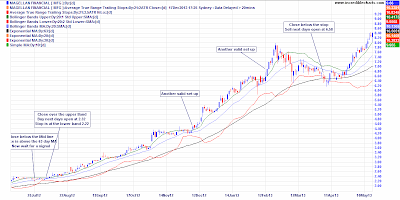

This is another entry

method that works well in trending markets. I am using the 63 day

moving average (Black) to define if a stock is trending. I have also

placed a couple of Bollinger Bands on the chart. The upper band

(Green) is at 1 standard deviation and the lower band (Red) is at 2

standard deviations of price. The middle Bollinger band (Blue) is

the 20 day simple moving average of the close.

I tend to be a momentum

buyer of stocks, so initially I look for a pause in the trend

signified here by a close below the middle (Blue) band followed by the price taking off again, signified by a close above the upper (Green)

band. Then it's simply a matter of buying the following days open,

holding on for the ride until the price closes below the lower band and

exiting on the following open.

|

| Courtesy of www.IncredibleCharts.com |

I mentioned before

that it's hard to lose money when a stock trends as well as MFG did

and this is a spectacular example. If you took the first entry and

hung on to the final stop, you trebled you money which is all well and

good, more importantly you made a massive return on risk and it is return on risk that ultimately defines our success as a trader.

There were a few later entries in this trend, one profitable, one not.

As a trader you have to decide if you should take only the first

entry or any of the subsequent ones, I offer no guidance on this

subject except to be consistent.

I will discuss Risk :

Return later, but the one thing I urge anyone to take away from this

chart is that if you take enough trades you will, from time to time,

own a stock like this. When you do it's very important to just hang

on and let the trend play out. It is in our nature to try to think

of a reason to snatch the profit available when it looks decent

enough particularly if we have had a bunch of losses recently or some

scary economic events spouting out of the TV. The simple

solution to this urge is Don't Do It!

These trades are your wealth builders. There has never been a large

profit that wasn't once a small profit.

There are endless variants on entry methods in stock trading. I am,

at heart, a rules based discretionary trader so I use rules to enter

and exit trades even though I can demonstrate that most of them don't

really add an edge (another future post). Just now I stuck “stock

trading entry methods” into Google. It returned exactly 193

million results in 0.39 of a second (a suspiciously round number, I

thought.) When I Googled Exit methods there were 'only' just over 31

million results, which may be one of the reasons most people don't

make money trading stocks.

If you want to learn and understand a few different styles of entry

AND exits, then I would recommend reading “Unholy Grails” by Nick

Radge and “The Layman’s Guide to Trading Stocks” by Dave

Landry. As I mentioned before, I don't get paid for mentioning these

books but having read around 100 different trading books, I can

happily say these are a couple of books (and people) that I wish I

had come across much earlier in my trading endeavours.

No comments:

Post a Comment