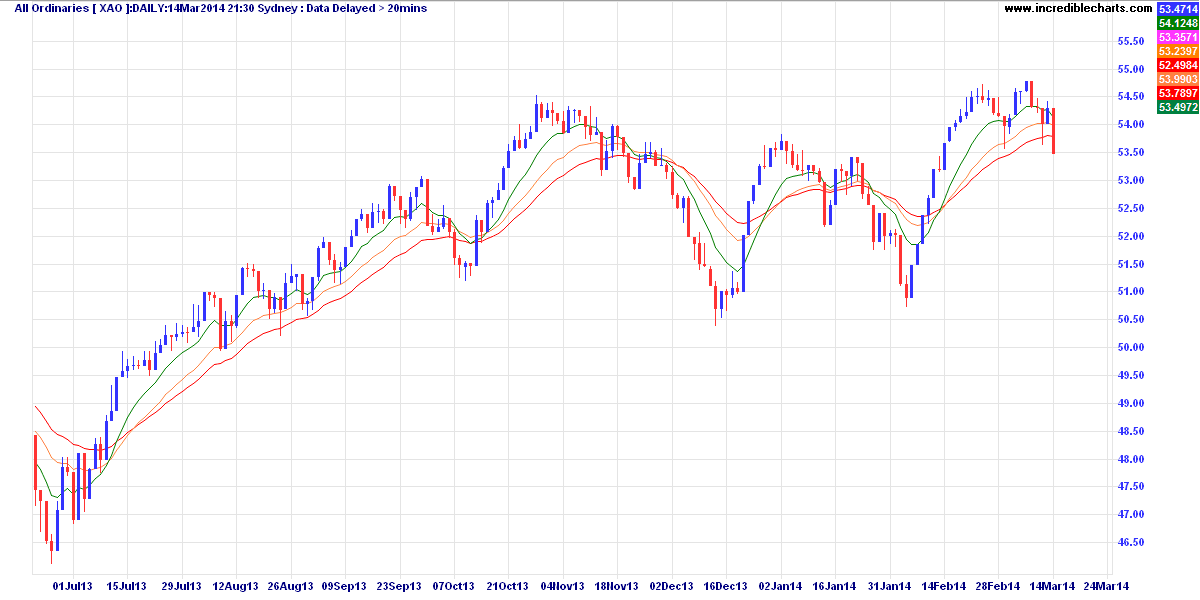

So far since inception the All Ordinaries has fallen 1.83%. The Hitcher Lost 6.75%, Flipper lost 8.13% and the Random portfolio made 1.87%. The numbers look like this:

There is very little we can deduce from this because there isn't enough data to work on. There are no closed profits. In trend following systems you cut losses quickly and let profits run so you should expect to take mostly losses early on. There is no real open profit except in the Random system. The All Ordinaries fell and so did most of the held stocks, so no surprise there.

Possibly the most interesting items are:

- The random portfolio didn't take a single closed loss while most of the Hitcher trades were losers. This is part pure luck and part due to the slightly different stop loss management. It will be interesting to watch this relationship develop.

- The Flipper system, which uses no leverage, performed worst of all. This is purely because there is no individual trend filter on the Flipper purchases. Some of the opening trades make me want to ignore the entry because it happily buys into multi-year down trends simply because there has been a little brightness on the horizon. This system has horrendous volatility which means huge gains AND draw-downs. Remember this whenever some marketer tries to sell you a system. It's easy to be blinded by the expected gains and written off by the actual losses.