There is quite a bit to discuss when it comes to kicking trades off. Indeed, there are probably more books, blogs, twitters, spams, magazine pages and acres of newsprint written on this one subject than any other aspect of trading. Personally I think the amount of time dedicated to entering trades is disproportionate and I hope to throw light on this over the following posts but, given that, to trade - one has to enter trades, I will add my own few hundred lines on the subject to the existing morass.

In 'Method part 2' I

discussed what my short list of stocks looks like. Given that I have

risk limits and portfolio size limits (you can just imagine more

method posts coming can't you?) how do I pick which to buy on any

given day?

I think I mentioned

that, as the list comprises a bunch of rising stocks, I could just

toss a coin, throw a dice or use a random number generator to select

one and buy it. I don't believe that any entry method offers

superior returns, I don't believe that money is made on the entry at

all, but, I also don't toss a coin etc. to choose stocks. Why not?

Well simply because I am human I suppose, and, this means that my

entry method has to match my personal beliefs about when is a good

time to buy.

So rather than go into

the nut's and bolt's of my entry method I will look at a few

different styles and what I think each may deliver. I will start

this discussion by stressing that the entry alone means

nothing! I never make a trade without knowing what will

cause me to close it. I cannot stress enough that I believe it

is the method of closing trades that makes the money.

Now that I have become all excited with bold underlined text - lets

get into it

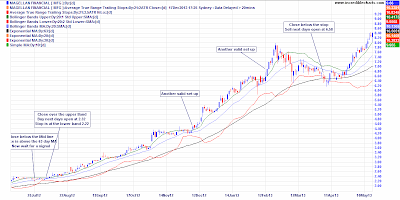

I will start with a chart of MFG, This stock was in a fabulous up

trend for a considerable period and this chart shows theoretical

entries using my current method. Alas I didn't actually take these

entries – I marked this chart up while I was digging around

creating the method, I wasn't chucking money into it at this stage

but it was almost the ideal stock for a while and I love this chart

because it shows what can happen when things are going well.

|

| Chart courtesy of www.IncredibleCharts.com |

The first alternative entry method is using an inside candle (A

candle where the high and low are contained within yesterdays high

and low). You can find this method all over the internet but

basically it consists of finding a trending stock and buying the

break above the inside candle. All I have done here is used a group

of moving averages to determine that a trend exists and close below

an average true range trailing stop as an exit. Lovely isn't it?

Bear in mind it's hard to lose money when a stock trends like this

|

Chart courtesy of www.IncredibleCharts.com

|

To be continued...