Disclaimer - Read this first!

This is not a signal service. While endeavoring to post signals before time occasionally I will only be able to post signals a day or two late.

I will not be including Fossil Fuel companies. Also I avoid stocks that are subject to takeover actions, are undertaking takeover actions or undertaking other corporate actions (share issues and the like).

I am not a financial adviser. Some of these are paper trades. I am not suggesting you follow these signals. If you take any action based on my blog you do so at your own risk.

-----------------------

Long term wealth creation - background.

My own investments are held in a portfolio much like the Easy system as well as a slowly growing longer term holding similar to that outlined below.

Our starting position was $200,000. The investment scenario is to have two quite different active investing styles that feed a long term buy and hold style.

- Easy System - A trend following system on the ASX 300 using weekly charts and trailing stops.

- Monthly Momo - A momentum system aims to hold the top ten stocks in the ASX 100 when it is on and nothing when off.

- Long Term - A buy and hold strategy based on index linked funds fed by dividend re-investment of the index funds themselves and the stocks in the above two systems.

Wherever possible I will be avoiding Fossil Fuel related companies. The starting position for this blog allocated $95,000 to each of the first two strategies and $10,000 to the long term

--------------------

Easy system: On.

Monthly Momentum system: On.

Easy Share Trading System.

System Status: On (as at 9th April 2023)

System details.

These trades are based on Peter Castle's 'Easy share trading system' with a few of my own tweaks. On his web site he kindly provides quite a few details on how his system works and a list of trade entry's each week which I will be using to run these trades here.

Peter also has an e-book with much more detail and explanation of his system and trading in general. I have recently read the book and encourage you to do so if you for a full explanation of the system. It would be unfair of me to exactly replicate that information here so I will continue using the method I had before I read the book.

- Only trade the Top 300 shares on the ASX. Only open positions when the system is on.

- Current Position Size = $7,452

- Select stocks priced between 10 cents and 25 dollars - theoretical price leverage.

- Buy the cheapest stock(s) on Peters 52 week high page assuming he continues listing them, Alternatively, buy the cheapest stock(s) in the ASX 300 making a 1 year high. For example: Friday's close is higher than last Friday's 50 week upper Donchian Channel That's the buy signal. The aim is to have approximately 10 stocks.

- Sell any stock if the EMA 7 falls below the EMA 12

- When the system turns off add an additional stop at 10% below the high of the last 3 weeks and any subsequent higher week until the system turns on again.

- If the system is on re-employ that money into further stock(s) using the same rules as 1 to 4.

- Any purchase should have a minimum $500,000 a day turnover (for my trading size).

- Use XAO_AX Weekly EMA 12 as an on off switch. This should smooth the equity curve even though it will probably also reduce returns a little.

Opening Stock Trades.

- None.

- None.

Closing Stock Trades.

- None.

-------------------

- None.

Monthly Momentum System.

System Status: On (as at 17th April 2023)

Next Re-balancing 15th May 2023

- Only trades when the ASX200 is rising as defined by a weekly close above the 27 week WMA + 1%. The system turns off when the ASX100 falls below the 27 Week WMA

- Buy the 10 highest momentum ASX 200 stocks in equal weights. Momentum is defined by the 12 Month (Measured using 52 week) ROC.

- Re-Balancing date will be around the 15th of each month.

- Stop Loss Rules.

- System on - Sell any stock not in the top 15 at the middle of each month. Replace with the best performing stock not currently held.

- System off - Sell Any stock not in the top 6 when the system turns off and any not in the top ten at the middle of each month. No Buying.

- Note - This simulation ran on the ASX100 until 13th March 2023 then changed to the ASX200. I am not trading this system (at the moment) but I will be updating each weekend just like the others - remember This is NOT a signal service

System Status: On (as at 17th April 2023)

Next Re-balancing 15th May 2023

- Only trades when the ASX200 is rising as defined by a weekly close above the 27 week WMA + 1%. The system turns off when the ASX100 falls below the 27 Week WMA

- Buy the 10 highest momentum ASX 200 stocks in equal weights. Momentum is defined by the 12 Month (Measured using 52 week) ROC.

- Re-Balancing date will be around the 15th of each month.

- Stop Loss Rules.

- System on - Sell any stock not in the top 15 at the middle of each month. Replace with the best performing stock not currently held.

- System off - Sell Any stock not in the top 6 when the system turns off and any not in the top ten at the middle of each month. No Buying.

- Note - This simulation ran on the ASX100 until 13th March 2023 then changed to the ASX200. I am not trading this system (at the moment) but I will be updating each weekend just like the others - remember This is NOT a signal service

Opening Stock Trades.

- None.

- None.

Closing Stock Trades.

- None.

--------------------

- None.

Long Term.

System Status: ON (as at 1st Sep 2019) This system is always on.

Next buying window 1st July 2023, next buy is ARG

- Only holds Index linked funds

- At the start of each quarter sum the dividends received in the easy and Momo system and buy alternatively AFI or ARG.

- Minimum buy is $1,500

- AFI and ARG holdings are set up for 100% dividend re-investment

System Status: ON (as at 1st Sep 2019) This system is always on.

Next buying window 1st July 2023, next buy is ARG

- Only holds Index linked funds

- At the start of each quarter sum the dividends received in the easy and Momo system and buy alternatively AFI or ARG.

- Minimum buy is $1,500

- AFI and ARG holdings are set up for 100% dividend re-investment

Opening Stock Trades.

- None.

--------------------

- None.

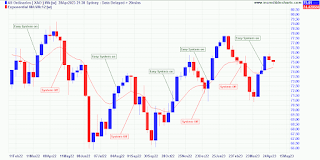

Chart(s) / Picture(s) of the Week

Current Trades

None.

Closed Trades Last Week.

None.

None.

No comments:

Post a Comment