Disclaimer - Read this first!

This is not a signal service. While endeavoring to post signals before time occasionally I will only be able to post signals a day or two late

I am not a financial adviser. These are paper trades. I am not suggesting you follow these signals. If you take any action based on my blog you do so at your own risk.

Weekly Trend Trading (WETT) System

System Status: ON (As at 30 May 2016) Take new positions. Existing stops stay as they were - new stops are approx 60% of buy price.

Opening Stock Trades

Nil

Closing Stock Trades

Nil

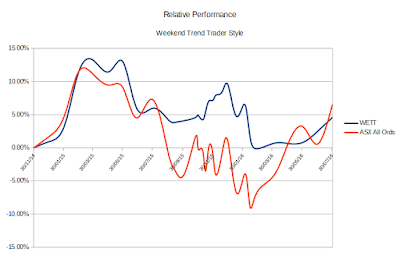

Performance as at end July 2016

July was fairly quiet in the WETT system, the All Ords rose a bit and so did the portfolio.

Here is the spreadsheet of current positions and a comparison chart to the All Ords.

Weekly Momentum System

System Status: ON - as at 30 May - Portfolio re-balanced monthly, positions checked weekly. Stop Loss either a weekly close below the 100 day SMA on the WEEKLY chart, or, a spike above 7% in the 2 day volatility on the daily chart.

Opening Stock Trades

Nil

Closing Stock Trades

Nil

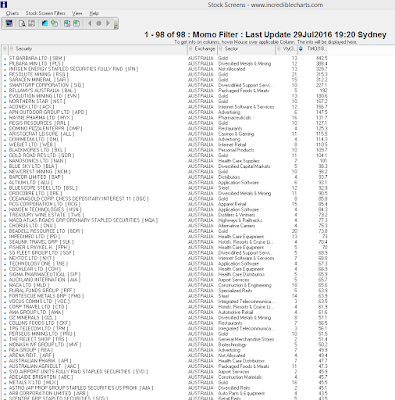

This Monday is monthly re-balancing day - I run the filter which gives the following output.

This is sorted by momentum and I want the portfolio to hold the 15 highest momentum stocks weighted by volatility. So, after dumping anything that has at a daily volatility spike in the last 6 weeks I fill out the following spreadsheet. 10 of the 15 were allready in the porfolio from last month so they simply need re weighting. BLA, GOR, OGC and ORE will be closed in full. Remember, I am ignoring any purchase or adjustment that doesn't have a transactional value of at least $2,000, With brokerage at $20 a side we don't want to be making tiny buys and sells all the time.

Chart(s) of the day

Nil

Further Information

Disclosure - Personal Interests: ALU and MQA

All Stock charts courtesy of www.IncredibleCharts.com

** WETT Trading style is Similar to the methodology described in 'The Weekend Trend Trader' by Nick Radge, Buy his book if you wish to discover how I am generating these signals (note: I do not receive any benefit from promoting Nick Radge, Dave Landry, Andreas F Clenow, Incredible Charts or anything else.)

Disclaimer - Read this first!

This is not a signal service. While endeavoring to post signals before time occasionally I will only be able to post signals a day or two late

I am not a financial adviser. These are paper trades. I am not suggesting you follow these signals. If you take any action based on my blog you do so at your own risk.

Weekly Trend Trading (WETT) System

System Status: ON (As at 30 May 2016) Take new positions. Existing stops stay as they were - new stops are approx 60% of buy price.

Opening Stock Trades

Nil

Closing Stock Trades

Nil

Weekly Momentum System

System Status: ON - as at 30 May - Portfolio re-balanced monthly, positions checked weekly. Stop Loss either a weekly close below the 100 day SMA on the WEEKLY chart, or, a spike above 7% in the 2 day volatility on the daily chart.

Opening Stock Trades

Nil

Closing Stock Trades

Sell SLK on Mondays open (100 day SMA Stop)

Sell TWE on Mondays open (100 day SMA Stop)

RSG sold last Monday - profit 0.6% of the portfolio.

Chart(s) of the day

Nil

Further Information

Disclosure - Personal Interests: ALU and MQA

All Stock charts courtesy of www.IncredibleCharts.com

** WETT Trading style is Similar to the methodology described in 'The Weekend Trend Trader' by Nick Radge, Buy his book if you wish to discover how I am generating these signals (note: I do not receive any benefit from promoting Nick Radge, Dave Landry, Andreas F Clenow, Incredible Charts or anything else.)

No comments:

Post a Comment