Disclaimer - Read this first!

This is not a signal service. While endeavoring to post signals before time occasionally I will only be able to post signals a day or two late

I am not a financial adviser. Some of these are paper trades. I am not suggesting you follow these signals. If you take any action based on my blog you do so at your own risk.

Easy Share Trading System

System Status: ON (As at 15 Aug 2016) Take new positions. Trailing stops are approx 25% of the most recent high. Note - I am starting this system 15th Aug 2016

System details

- Only trade the Top 300 shares on the ASX and put 10% of your money in each stock.

- Select stocks priced between 10 cents and 20 dollars, they go up more quickly than more expensive stocks and yes there are plenty of stocks in that price range in the ASX 300.

- Buy the stock if it makes a 1 year high. For example: today’s price of $2 is the highest the stock has been for a year. That’s the buy signal. If there is more than one stock that week making a 1 year high, pick the cheapest one.

- Sell the stock if it at any time since it's highest recent price it falls more than 25%. For example: If you buy the stock at $2, and it rises to $4 but then falls 25% to $3, you sell. This is called the 25% Stop Loss Rule.

- Now re-employ that money into another stock that is making a 1-year high and use the same rules as 1 to 4.

- Any purchase ahould have a minimum $500,000 a day turnover for my trading size.

- Use XAO_AX EMA 20 and EMA 30 as an on off switch. This should smooth the equity curve even though it will probably also reduce returns a little.

Opening Stock Trades

Buy GDI on Monday's open

Closing Stock Trades

Nil

I just kicked this system off two weeks ago so not much to report yet

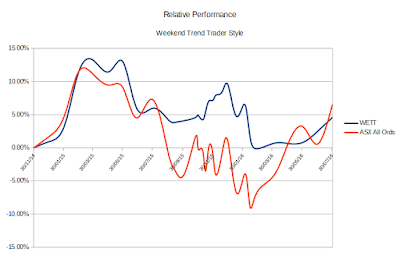

Weekly Momentum System

System Status: ON - as at 30 May - Portfolio re-balanced monthly, positions checked weekly. Stop Loss either a weekly close below the 100 day SMA on the WEEKLY chart, or, a spike above 7% in the 2 day volatility on the daily chart.

Opening Stock Trades

See Speadsheet

Closing Stock Trades

WEB was closed last Monday

A cluster of stocks have closed below their 100 day moving average or were no longer in the high momentum ranks so first up we need to close the following trades...

- ACX

- APO

- IFN

- NST

- OML

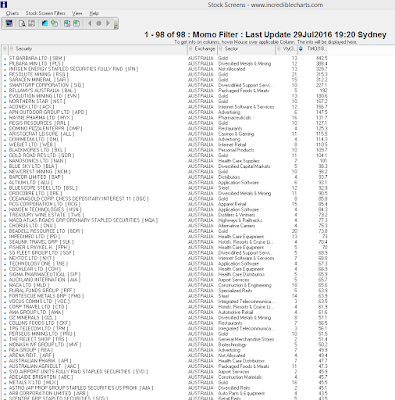

This Monday is monthly re-balancing day. Here is the output of the momentum filter.

I have sorted the filter by momentum and I want the portfolio to hold the 15 highest momentum stocks weighted by volatility. So, after dumping anything that has a daily volatility spike in the last 6 weeks, I filled out the following spreadsheet. 8 of the 15 were already in the portfolio from last month so they simply need re weighting. Remember, I am ignoring any purchase or adjustment that doesn't have a transaction value of at least $2,000, With brokerage at $20 a side we don't want to be making tiny buys and sells all the time.

Chart(s) of the day

Nil

Further Information

Disclosure - Personal Interests: CWY, MYR, ALU, APO, CHC, FBU, GUD, MQA, NAN, SDF, SIP, SXL

** EASY system based on Peter Castle's http://EasyShareTradingSystems.com.au site. I can't directly endorse his approach simply because I don't have the facility to back test his methods but, to me at least, they make a lot of sense. The same is true for the Momo system which is based on Andreas Clenow's book. (note: I do not receive any benefit from promoting Peter Castle, Nick Radge, Dave Landry, Andreas F Clenow, Incredible Charts or anything else.)