Disclaimer - Read this first!

This is not a signal service. While endeavoring to post signals before time occasionally I will only be able to post signals a day or two late

I am not a financial adviser. Some of these are paper trades. I am not suggesting you follow these signals. If you take any action based on my blog you do so at your own risk.

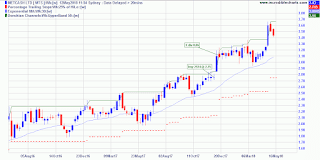

Easy Share Trading System.

System Status: ON (As at 5th May 2018) Take new positions. Trailing stops are approx 25% of the most recent high.

System details.

- Only trade the Top 300 shares on the ASX and put 10% of your money in each stock.

- Current Position Size = $7,000

- Select stocks priced between 10 cents and 20 dollars - theoretical price leverage.

- Buy the stock if it makes a 1 year high. For example: Friday's close is higher than last Friday's 50 week upper Donchian Channel That's the buy signal. If there is more than one stock that week making a 50 week high, pick the cheapest one.

- Sell the stock if it at any time since it's highest recent price it falls more than 25%. For example: If you buy the stock at $2, and it rises to $4 but then falls 25% to $3, you sell. This is called the 25% Stop Loss Rule.

- Now re-employ that money into another stock that is making a 1-year high and use the same rules as 1 to 4.

- Any purchase should have a minimum $500,000 a day turnover for my trading size.

- Use XAO_AX Daily EMA 20 and Daily EMA 30 as an on off switch. This should smooth the equity curve even though it will probably also reduce returns a little.

Opening Stock Trades.

- Nil.

Closing Stock Trades.

- Nil.

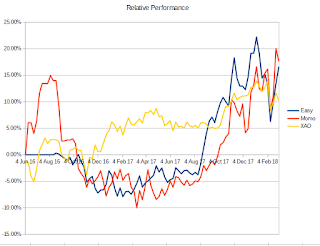

Monthly Momentum System.

System Status: ON - as at 5th May 2018.

Next Re-balancing 2nd July 2018.

- Only trades when the ASX 100 is rising as defined by the Daily 20/30 EMAs.

- 1st Monday of each new month Buy the 5 highest momentum ASX 100 stocks in equal weights.

- Stop Loss Rules.

- System on - Any stock not in the top 5 at the beginning of each month.

- System off - Any monthly close below the 10 month simple moving average of the close.

- Note - I am not trading this system (at the moment) but I will be updatng each weekend just like the others - remember This is NOT a signal service

Opening Stock Trades.

- NST.

Closing Stock Trades.

- FLT - Rebalancing stop.

Further Information

Disclosure - Personal Interests: AWC, AMA, CGC, CWY, GDI, LYC, RFF, SDF, SSM, SWM, IMD, S32, WOR.

All Stock charts courtesy of www.IncredibleCharts.com

Note: I do not receive any benefit from promoting Nick Radge, Dave Landry, Andreas F Clenow, Easy Share Trading Systems, Incredible Charts or anything else.

For more information on the Easy Share Trading System see http://www.easysharetradingsystems.com.au/objective-and-planing/i-know-what-you-want