Disclaimer - Read this first!

This is not a signal service. While endeavoring to post signals before time occasionally I will only be able to post signals a day or two late

I am not a financial adviser. Some of these are paper trades. I am not suggesting you follow these signals. If you take any action based on my blog you do so at your own risk.

Easy Share Trading System.

System Status: ON (As at 16 Oct 2017) Take new positions. Trailing stops are approx 25% of the most recent high.

System details.

- Only trade the Top 300 shares on the ASX and put 10% of your money in each stock.

- Current Position Size = $7,000

- Select stocks priced between 10 cents and 20 dollars - theoretical price leverage.

- Buy the stock if it makes a 1 year high. For example: Friday's close is higher than last Friday's 50 week upper Donchian Channel That's the buy signal. If there is more than one stock that week making a 50 week high, pick the cheapest one.

- Sell the stock if it at any time since it's highest recent price it falls more than 25%. For example: If you buy the stock at $2, and it rises to $4 but then falls 25% to $3, you sell. This is called the 25% Stop Loss Rule.

- Now re-employ that money into another stock that is making a 1-year high and use the same rules as 1 to 4.

- Any purchase should have a minimum $500,000 a day turnover for my trading size.

- Use XAO_AX Daily EMA 20 and Daily EMA 30 as an on off switch. This should smooth the equity curve even though it will probably also reduce returns a little.

Note: LYC had a 10:1 consolidation on 1st Dec.

Opening Stock Trades.

- Nil.

Closing Stock Trades.

- Nil.

Weekly Momentum System.

System Status: ON - as at 15 October 2017 - Portfolio re-balanced each five weeks, positions checked weekly. Stop Loss either a close below the 2.7 x 21 week Average True Range, or, a spike above 7% in the 2 day volatility on the weekly chart.

Next Re-balancing - Due to time constraints I will wind this system down by monitoring stops but making no further purchases. Having run this system for 18 months I have decided it's not one I would trade myself primarily due to the high no of transactions it generates.

Opening Stock Trades.

- No further purchases on this system as from 2nd jan 2018.

Closing Stock Trades.

- Nil.

Monthly Momentum System.

System Status: ON - as at 16 October 2017.

Next Re-balancing 1st January 2018.

- Only trades when the ASX 100 is rising as defined by the Daily 20/30 EMAs.

- 1st Monday of each new month Buy the 5 highest momentum ASX 100 stocks in equal weights.

- Stop Loss Rules.

- System on - Any stock not in the top 5 at the beginning of each month.

- System off - Any monthly close below the 10 month simple moving average of the close.

- Note - I am not trading this system (at the moment) but I will be updatng each weekend just like the others - remember This is NOT a signal service

Opening Stock Trades.

- Nil.

Closing Stock Trades.

- Buy NST.

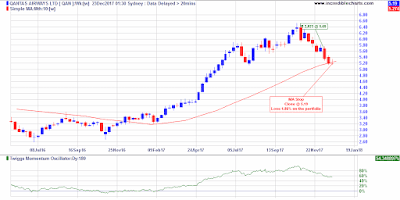

Chart of the Week

Equity.

We can see here that the Easy sytem is chugging along nicely. It is also a very easy system to trade as its name implies. Remember that the idea of doing this is to make money not sit glued to a screen trying to interpret trading signals which is why the weekly momentum system is being dropped. The Monthly momentum system hasn't done much yet but it is very early days.

Further Information

Disclosure - Personal Interests: AWC, CGC, CWY, GDI, LYC, MTS, PLS, RFF, SDF, SSM, ASL, BWX, CKF, IMD, KDR, NWH, PME, S32, WOR.

All Stock charts courtesy of www.IncredibleCharts.com

Note: I do not receive any benefit from promoting Nick Radge, Dave Landry, Andreas F Clenow, Easy Share Trading Systems, Incredible Charts or anything else.

For more information on the Easy Share Trading System see http://www.easysharetradingsystems.com.au/objective-and-planing/i-know-what-you-want