Disclaimer - Read this first!

This is not a signal service. While endeavoring to post signals before time occasionally I will only be able to post signals a day or two late

I am not a financial adviser. Some of these are paper trades. I am not suggesting you follow these signals. If you take any action based on my blog you do so at your own risk.

Easy Share Trading System

System Status: ON (As at 28 November 2016) Take new positions. Trailing stops are approx 25% of the most recent high.

System details

- Only trade the Top 300 shares on the ASX and put 10% of your money in each stock.

- Select stocks priced between 10 cents and 20 dollars - theoretical price leverage.

- Buy the stock if it makes a 1 year high. For example: Friday's close is higher than last Friday's 50 week upper Donchian Channel That's the buy signal. If there is more than one stock that week making a 50 week high, pick the cheapest one.

- Sell the stock if it at any time since it's highest recent price it falls more than 25%. For example: If you buy the stock at $2, and it rises to $4 but then falls 25% to $3, you sell. This is called the 25% Stop Loss Rule.

- Now re-employ that money into another stock that is making a 1-year high and use the same rules as 1 to 4.

- Any purchase should have a minimum $500,000 a day turnover for my trading size.

- Use XAO_AX Daily EMA 20 and Daily EMA 30 as an on off switch. This should smooth the equity curve even though it will probably also reduce returns a little.

Opening Stock Trades - This week the market opens on Wednesday 28th

- Nil

Closing Stock Trades

- Nil

Weekly Momentum System

System Status: ON - as at 28 November 2016 - Portfolio re-balanced monthly, positions checked weekly. Stop Loss either a weekly close below the 100 day SMA on the WEEKLY chart, or, a spike above 7% in the 2 day volatility on the daily chart.

*** From 1 Jan 17 - I have decided to tweak the rules slightly on this system. When the system is on a 100 day SMA stop will chop one out of trades whenever there is a stall in the price rise often taking you out at or near the low of a retracement. Remember that the point of these trades is to take high momentum stocks when the system is on but revert to cash when it switched off. The new stop method will be -

- The volatility stop will always be in place.

- When the system is ON I will use a 2.7 * 21 week Avge True Range at the close as the stop.

- When the system is OFF the 100 day SMA stop will rule.

Opening Stock Trades

- refer momentum filter below

Closing Stock Trades

- Nil

- CCP and PLS were closed Last Monday

This Tuesday 3rd Jan 2017 is monthly re-balancing day. Here is the output of the momentum filter.

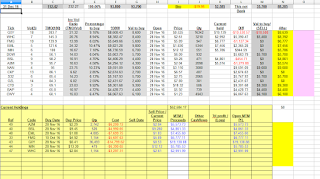

I have sorted the filter by momentum and I want the portfolio to hold the 15 highest momentum stocks weighted by volatility. So, after dumping anything that has a daily volatility spike in the last 6 weeks, I filled out the following spreadsheet. 7 of the 15 were already in the portfolio from last month so they simply need re weighting. Remember, I am ignoring any purchase or adjustment that doesn't have a transaction value of at least $2,000, With brokerage at $20 a side we don't want to be making tiny buys and sells all the time.

Chart of the Week

Nil.

Equity Chart

I have combined both systems into one chart in order to gauge relative performance. Naturally with the Easy system starting later than the Momo system there is a little lag there but not enough to make it bothersome over the long run.

We can see that at the moment the recent choppy market has meant that we have taken lots of stops and no real momentum has developed in our holdings to create profit. This is quite normal but frustrating. One of the reasons I adjusted the stop method on the Momo was to (hopefully) alleviate some of this.

Further Information

Disclosure - Personal Interests: AWC, BPT, CGC, CSR, CWY, GDI, MLD, RFF, SIP, SXL, BSL, CDA, CKF, FBU, GMA, GUD, NAN, OZL, S32, WOR.

All Stock charts courtesy of www.IncredibleCharts.com

Note: I do not receive any benefit from promoting Nick Radge, Dave Landry, Andreas F Clenow, Incredible Charts or anything else.